- Courtenay Webster

- Stakeholder Communications Consultant and Partner

- Opinion

- 20 June 2024

- 3 min

Share

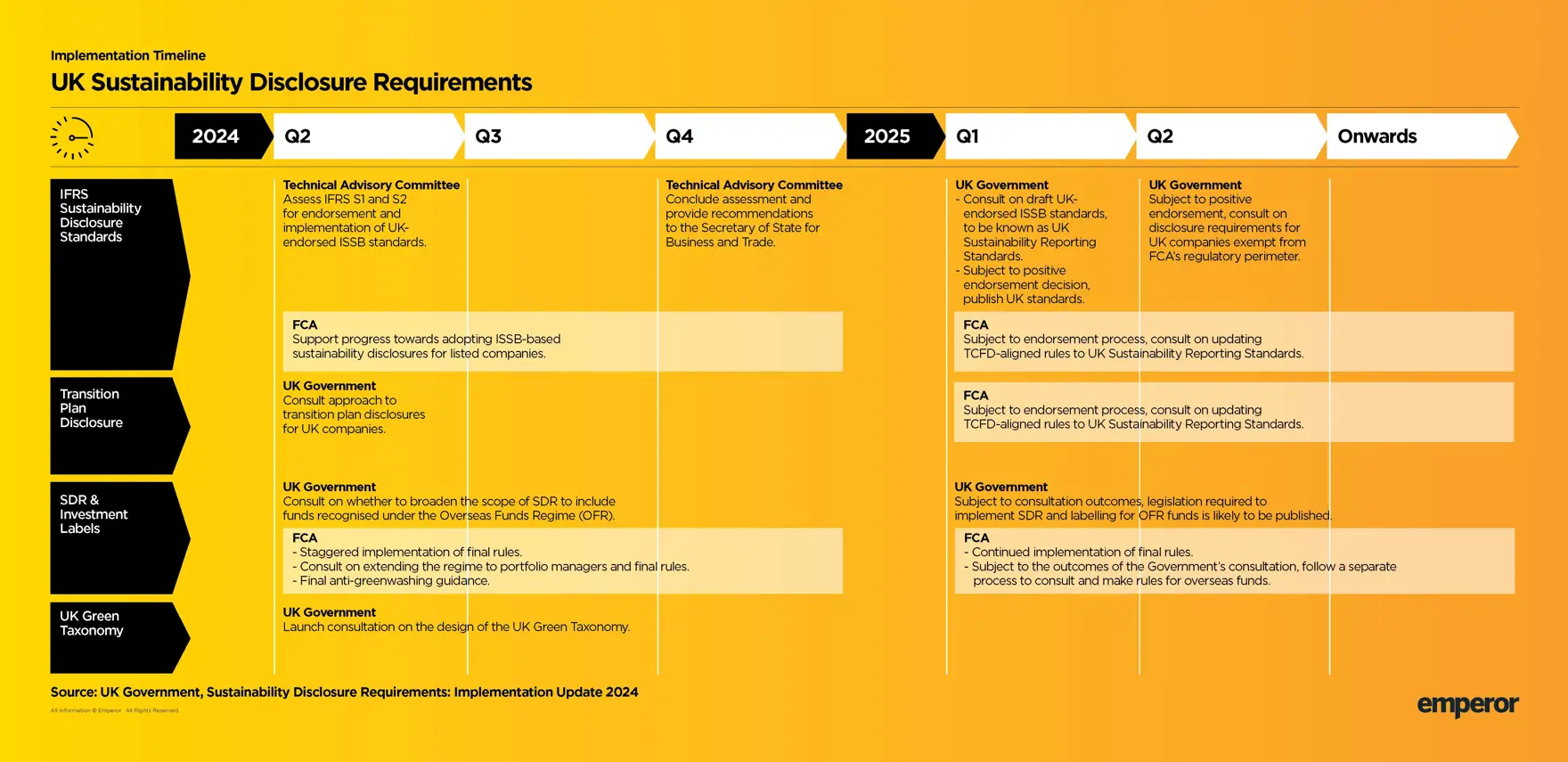

The UK Government recently published an implementation update, including timeframes and milestones, to the Sustainability Disclosure Requirements (SDR).

As part of the Green Finance Strategy updated in March 2023, UK SDR is a package of disclosures and rules aimed at tackling greenwashing and facilitating information between corporates, consumers, investors, and capital markets. It is built on global best practice and leading standards, notably the ISSB standards.

The implementation update has been a long-awaited next step since the Green Finance Strategy 2023, so let’s dive in and see what the UK Government has in store for the SDR components and how companies can start preparing for the evolving regulations.

What are the key takeaways from the published SDR update?

For more details on the UK SDR implementation, click here.

Although we are seeing delays, SDR, and more specifically the ISSB-endorsed standards, have stepped into the spotlight and the ball is rolling. This brings us to the question: what is your next move?

Preparing for the Future

We know the UK Government has clear intent to endorse the ISSB standards. Companies likely to be in scope of SDR can proactively prepare by assessing how to implement the ISSB standards and the TPT Disclosure Framework. While mandatory reporting isn't immediate, it is looming. Engage with the policymaking process, prepare, and plan, to stay ahead of the curve.

As we continue to keep an eye on the evolving regulations, one thing remains clear: the sooner you start, the smoother this transition will be.

For further advice and support get in touch at [email protected].